Uncategorized

When I first arrived in Germany as a student, everything felt precise—trains arrived on time, streets were quiet, and rules seemed to exist for every small thing. Coming from Pakistan, where life moves with a different rhythm, the adjustment was…

Uncategorized

Moving from Pakistan to Germany sounded glamorous when I first got my student visa. Everyone back home imagined sleek campuses, futuristic labs, and a life that looked like a postcard. The reality? A mix of breathtaking, confusing, lonely, and unexpectedly…

Uncategorized

If someone had told me that the biggest challenge in Germany wouldn’t be the language, the weather, or the academics—but learning how to make eye contact with strangers—I would’ve laughed. Yet here I am, months into my student life, still…

Uncategorized

When I first landed in Germany, the cold hit me harder than the jet lag. Everything felt unfamiliar — the language, the food, even the silence. Back home in Pakistan, streets buzzed with noise, laughter, and chai stalls. Here, the…

Uncategorized

When I first landed in Germany for my master’s, I thought I was ready for everything — the language, the culture, the food. What I wasn’t ready for was the silence. Back home in Pakistan, life is noisy — horns,…

Uncategorized

Studying in Germany has been one of the most transformative experiences of my life. As a student from Pakistan, moving to a completely different culture, education system, and lifestyle was both exciting and overwhelming. But every challenge here has turned…

Uncategorized

One of my close friends here in Germany is an Indian guy from Chennai. I met him in German class, and we clicked instantly. And over the past year, we have been helping each other navigate language barriers, part-time jobs…

Uncategorized

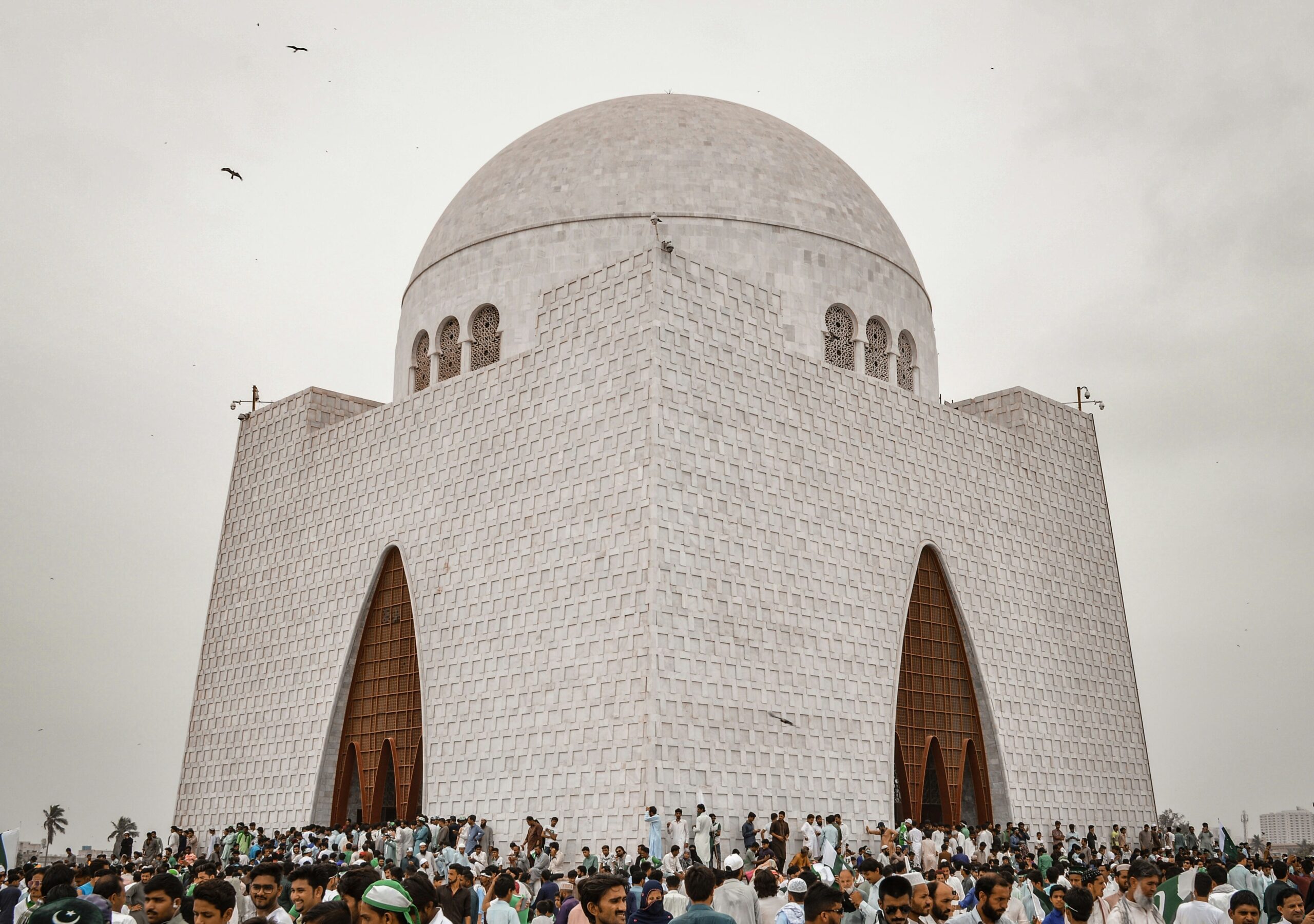

When I walk on the cold streets of Germany, my hands stuffed into my pockets, I think about my father’s sweet shop back home in Karachi. I’m filled with that familiar smell of ghee and sugar, the chatter of customers,…

Uncategorized

When you’re an International student studying in Germany, you quickly realize that your scholarship or family support goes only so far. Beyond that, you need to work hard. I’m a Pakistani studying data science here, and I know how much…

Uncategorized

When I first started researching colleges abroad, and I finally selected Germany, curious relatives were constantly on with the questions. How long will you be studying there? When will you come back? Are there even good jobs there for Pakistanis?…